Standard Deduction 2025 Mfj Over 65 - 2025 Standard Deduction Over 65 Calculator Jade Roselle, Section 63 (c) (2) of the code provides the standard deduction for use in filing individual income tax returns. Standard Deduction 2025 Mfj Over 65 Sunny Ernaline, Depending on your tax rate and filing status, you’ll owe different amounts on different parts of your income depending on your taxable income.

2025 Standard Deduction Over 65 Calculator Jade Roselle, Section 63 (c) (2) of the code provides the standard deduction for use in filing individual income tax returns.

This higher deduction helps to offset some of the increased. A person is considered to reach age 65 on the day before his or her 65th.

Standard Tax Deduction For 2025 Over 65 Ashely Karolina, Standard deduction 2025 mfj over 65.

2025 Standard Deduction Single Over 65 Liz Kameko, Federal tax brackets range from 10% to 37%.

Standard Deduction 2025 Married Filing Jointly Calculator Neely Wenonah, 2025 tax deduction over 65 fae kittie, federal income tax rates and brackets.

2025 Standard Deduction Over 65 Married Deena Marillin, Story by times now digital.

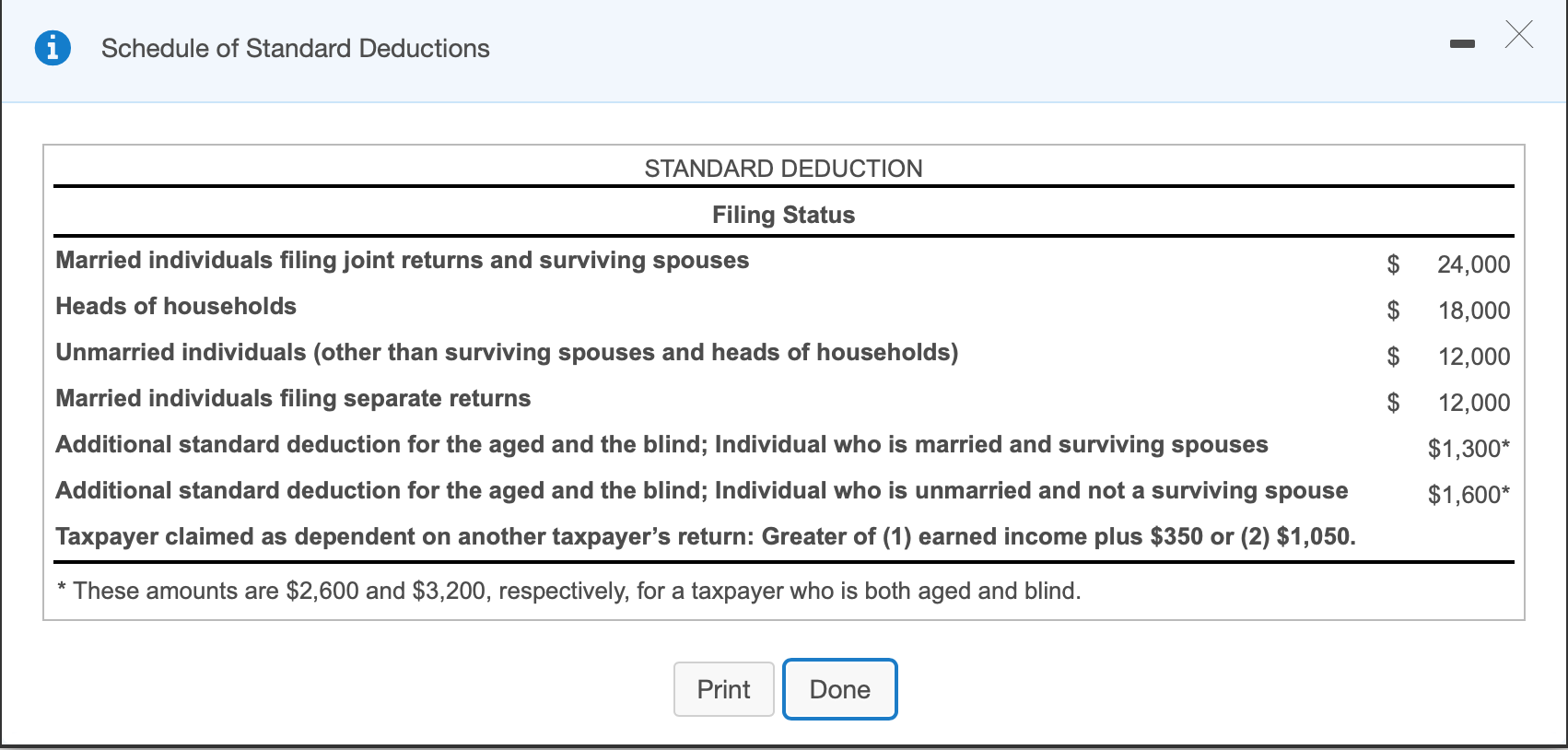

Standard Deduction 2025 Mfj Over 65. To qualify for the additional standard deduction, you must be at least 65 years old by the second day of the calendar year (january 2). You're allowed an additional deduction for blindness if you're blind on the last day of the tax year.

2025 Standard Deduction Mfj Over 65 Camala Claudia, Section 63 (c) (2) of the code provides the standard deduction for use in filing individual income tax returns.

Tax Year 2025 Standard Deduction For Seniors Arda, Standard deduction 2025 mfj over 65.

What Is The Standard Deduction For 2025 Mfj Cybill Chandra, Standard deduction 2025 mfj over 65 van lilian, for the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single.

Irs Standard Deduction 2025 Over 65 Single Gerri Juanita, In total, a married couple 65 or older would have a standard deduction of $32,300.